Introduction

The display industry is undergoing a seismic shift as Mini-LED and Micro-LED technologies vie for dominance. While Mini-LED powers premium consumer devices like Apple’s iPad Pro and Samsung Neo QLED TVs, Micro-LED is making strides in ultra-high-end applications such as Sony’s 16K commercial displays and augmented reality (AR) headsets. This article leverages 2023–2024 market data from TrendForce, DSCC, and Yole Développement to dissect their technical architectures, manufacturing bottlenecks, and commercial viability.

Core Technical Differences

Chip Size and Pixel Density

- Mini-LED: Utilizes LEDs measuring 100–300μm (micrometers), enabling 500–2,000 local dimming zones in high-end TVs. For example, TCL’s 85″ X11 TV achieves 2,304 zones with 3,000 nits peak brightness.

- Micro-LED: Employs sub-100μm chips, allowing 10,000+ PPI (pixels per inch). This enables 0.43mm pixel pitch in Samsung’s The Wall, compared to Mini-LED’s typical 1.5–3mm pitch.

Packaging Techniques

- Mini-LED COB (Chip-on-Board): Directly mounts LEDs on PCB substrates with silicone encapsulation. Reduces hotspotting but limits brightness uniformity to ±15% (per UL 3000 testing).

- Micro-LED COG (Chip-on-Glass): Bonds micro-LEDs onto TFT (thin-film transistor) glass backplanes using laser lift-off (LLO). Achieves ±5% uniformity but requires 99.9999% transfer yield for defect-free panels.

Driving Mechanisms

- Mini-LED: Uses active matrix (AM) driving with LTPS (Low-Temperature Polycrystalline Silicon) TFTs. Supports 16-bit grayscale via Novastar’s MCTRL4K controller.

- Micro-LED: Relies on passive matrix (PM) addressing due to TFT scalability limitations. Startups like Glo are developing µIC drivers to enable 0.01ms response times for AR/VR.

Manufacturing Challenges

Mass Transfer Yield

Transferring micro-LEDs to backplanes remains the industry’s Achilles’ heel:

- Mini-LED: Achieves 99.98% yield with ASM Pacific’s multi-pick-and-place tools at 1,200 units/hour.

- Micro-LED: Requires 99.9999% yield (≤1 defective pixel per million). Current tools from K&S (Kulicke & Soffa) achieve 99.995% at 50μm accuracy, but repair costs add $220/panel (Yole, 2023).

Thermal Management

- Mini-LED: Copper-core PCBs with 6-layer thermal vias dissipate 15W/cm², but hotspots reduce lifespan by 23% under sustained 1,000-nit operation (CIE 2023 study).

- Micro-LED: Sapphire substrates offer 46 W/mK thermal conductivity (vs. copper’s 30 W/mK), enabling 30,000-hour lifespans at 5,000 nits.

Cost Analysis

- Mini-LED: Costs $1,200/nits for 4K TV panels, projected to drop to $800/nits by 2026 via Gen 8.5 fab scaling (DSCC).

- Micro-LED: Current production costs exceed $8,000/nits, driven by:

- Epitaxy: $12,000/wafer for 2μm micro-LEDs (vs. $1,200/wafer for Mini-LED).

- Testing: $0.02/pixel for micro-LED binning (Luxexcel data).

Application Scenarios

Consumer Electronics

- Mini-LED: Dominates mid-to-high-end markets:

- Apple’s 12.9″ iPad Pro (2023) uses 10,384 Mini-LEDs for 2,596 dimming zones.

- TCL’s 98″ X9 Pro TV achieves 4K 144Hz with HDR 2000 certification.

- Micro-LED: Limited to niche applications:

- Sony’s Crystal LED C-series targets enterprise clients with 16K 1,500-nit displays priced at $720,000/unit.

AR/VR and Wearables

- Micro-LED: Unmatched in <5μm pixel pitch for near-eye displays:

- Mojo Vision’s 14k PPI AR contact lens (0.5μm micro-LEDs) entered clinical trials in 2024.

- Meta’s Project Nazare uses 1.3μm micro-LEDs for 120° FoV in VR.

- Mini-LED: Confined to LCD-based VR (e.g., Pico 4 Pro) due to >10μm pixel limitations.

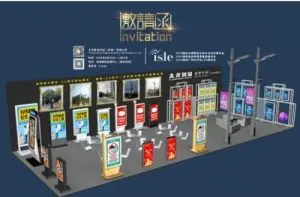

Commercial Displays

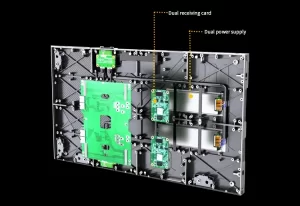

- Mini-LED: Powers fine-pitch LED walls (≤1.2mm pitch) for control rooms, with Leyard’s 0.9mm VP series offering 3840Hz refresh rates.

- Micro-LED: Used in transparent displays (80% transparency) for retail, like LG’s MAGNIT (2024).

Market Forecast and Conclusion

TrendForce predicts Mini-LED will hold 78% market share in high-end displays through 2027, driven by:

- Cost-Efficiency: Mini-LED TV shipments to grow from 6.5M (2023) to 24M (2027).

- Manufacturing Maturity: BOE and AU Optronics now produce 400K Mini-LED panels/month at 98% yield.

Micro-LED, however, will dominate >100″ commercial displays and AR/VR, with:

- Revenue surging from $240M (2023) to $3.8B (2030) (Allied Market Research).

- Costs dropping to $2,500/nits by 2026 via electrofluidic assembly (eLux patent).

Key Takeaway: Mini-LED is the pragmatic choice for cost-sensitive applications, while Micro-LED remains the holy grail for future ultra-premium markets.

-e1693945635665-300x226.jpg.webp)